Taxation in Portugal

Taxation in Portugal is organized around a progressive framework that covers both individuals and corporations. The primary tax for individuals is the personal income tax, known as IRS (Imposto sobre o Rendimento das Pessoas Singulares), which applies to residents on their worldwide income and to non-residents on Portuguese-sourced income only. The country also applies corporate income tax (IRC), value-added tax (IVA), property taxes, and a range of indirect levies. For expatriates and foreign investors, Portugal offers one of the most transparent and predictable tax environments in Southern Europe.

The Portuguese tax year runs from January 1 to December 31. Residents file returns in the spring of the following year, declaring income earned domestically and abroad. The system also includes withholding at source for employees and certain categories of investment income. Double tax treaties with over 70 countries reduce the risk of double taxation, a key factor for North American and European expats moving to Portugal.

For context, Portugal’s tax revenues make up about 35% of GDP, slightly below the EU average. This balance reflects moderate direct taxation combined with indirect taxes such as VAT and excises on alcohol, fuel, and tobacco. Local municipalities also collect surcharges on corporate profits and property values, creating a layered but manageable structure.

Personal income taxation (IRS)

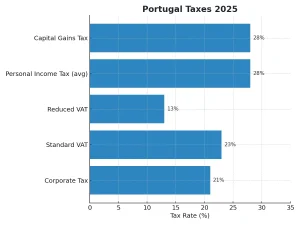

Portugal applies progressive rates to personal income, with higher earners paying significantly more. Residents are taxed on worldwide income, including employment, self-employment, pensions, and investments. Non-residents are subject to a flat rate of 25% on Portuguese-sourced income, primarily salaries, rental income, and dividends.

As of the most recent schedule, the IRS applies the following brackets:

| Taxable income (EUR) | Rate |

| Up to 7,479 | 14.5% |

| 7,480 – 11,284 | 21% |

| 11,285 – 15,992 | 26.5% |

| 15,993 – 20,700 | 28.5% |

| 20,701 – 26,355 | 35% |

| 26,356 – 38,632 | 37% |

| 38,633 – 50,483 | 43.5% |

| 50,484 – 78,834 | 45% |

| Above 78,834 | 48% |

In addition to the standard rates, Portugal levies a “solidarity surcharge” of 2.5% on income between €80,000 and €250,000 and 5% on income exceeding €250,000. This means that high-income earners can face effective rates above 50%, making tax planning crucial. Allowances for dependents, mortgage interest, health, and education costs can reduce taxable income, while pensioners benefit from specific exemptions when relocating under special regimes.

Non-residents cannot claim most deductions but enjoy flat taxation that simplifies compliance. For U.S. citizens living in Portugal, IRS coordination with the Internal Revenue Service under the tax treaty helps reduce double taxation, though U.S. citizens must continue to file annual returns with the IRS.

Corporate taxation in Portugal

Corporate tax in Portugal is charged at a headline rate of 21% on profits. Municipal surcharges (Derrama Municipal) of up to 1.5% apply, varying by municipality. Additionally, a state surcharge (Derrama Estadual) applies on profits exceeding €1.5 million, with marginal rates rising to 9% for large corporations.

Small and medium enterprises (SMEs) benefit from reduced rates on the first €25,000 of taxable income, typically 17%. Startups and companies operating in Portugal’s interior regions may qualify for additional incentives, including tax credits and reduced rates. Madeira and the Azores offer specific tax regimes under EU approval, making them attractive hubs for international businesses.

| Company type / income | Effective tax rate |

| Standard corporation | 21% + local surtax up to 1.5% |

| SME (first €25,000) | 17% |

| Profits €1.5M–7.5M | +3% state surcharge |

| Profits €7.5M–35M | +5% state surcharge |

| Profits above €35M | +9% state surcharge |

Corporate tax returns are due annually, with advance payments throughout the year based on estimated profits. Losses can be carried forward for 12 years but only offset up to 70% of taxable income in each year. Transfer pricing and controlled foreign company (CFC) rules apply, reflecting EU-wide anti-avoidance directives.

VAT (IVA) and indirect taxes

Portugal applies a value-added tax (IVA) with three tiers. The standard rate is 23% on most goods and services on the mainland. A reduced rate of 13% applies to specific items, including certain foodstuffs, while a super-reduced rate of 6% covers basic necessities, newspapers, and medicines. Madeira and the Azores enjoy slightly lower rates, with standard IVA of 22% and 18% respectively.

See also: Moving to Portugal

In addition to VAT, excise duties apply to fuel, alcohol, and tobacco. Motor vehicle taxes are another key source of indirect revenue, calculated on engine size, CO2 emissions, and age of the vehicle. Property transfers attract stamp duty, typically 0.8% of the purchase price, and various local fees. These indirect taxes make up a significant portion of government revenue and must be considered in cost-of-living calculations.

Businesses exceeding annual turnover thresholds (generally €12,500) must register for VAT. Compliance includes quarterly reporting, with electronic submissions through the national e-filing system.

Special tax regimes

Portugal has created targeted tax incentives to attract skilled professionals and retirees. The most famous is the Non-Habitual Resident (NHR) regime. Available for the first 10 years of residence, NHR offers a flat 20% rate on income from high-value activities (e.g., IT, engineering, medical fields) earned in Portugal, rather than progressive rates up to 48%. Foreign-sourced income such as pensions, dividends, and royalties may be exempt from Portuguese tax under NHR, depending on treaty provisions.

This regime has proven popular with expatriates from the United States, Canada, and Northern Europe, offering a significant reduction in tax burden during the initial decade of residence. NHR also exempts many foreign pensions from Portuguese taxation if they are taxable in the source country, though recent reforms have introduced a flat 10% rate on certain pensions to comply with EU concerns.

Portugal also offers special incentives for R&D investments, patent income, and regional development in less populated areas. Companies locating in Madeira’s International Business Centre can qualify for reduced corporate tax rates, though EU scrutiny requires strict adherence to substance rules.

Property and wealth-related taxes

Property ownership in Portugal carries several fiscal obligations. The annual municipal property tax (IMI) applies at rates between 0.3% and 0.8% of the property’s taxable value, determined by local councils. High-value residential properties above €600,000 are subject to the Additional Municipal Property Tax (AIMI), levied at 0.7% for individuals and 1% for corporations, with higher rates for very high-value portfolios.

When acquiring real estate, buyers must pay the property transfer tax (IMT). Rates vary depending on the type and value of property, reaching up to 7.5% for luxury homes. Stamp duty at 0.8% also applies on top of IMT. Sellers may face capital gains tax on profits from sales, calculated at standard income tax rates, though exemptions exist for reinvestment into a primary residence.

Portugal does not levy a wealth tax per se, and there is no inheritance or gift tax between close family members. Transfers to non-relatives attract stamp duty at 10%, a figure still competitive by European standards.

Tax compliance and practical issues

All residents and property owners in Portugal must obtain a tax identification number (Número de Identificação Fiscal, NIF). This number is required for opening bank accounts, signing leases, purchasing property, and filing tax returns. The annual income tax declaration (Modelo 3) is submitted electronically, typically between April and June for the previous year.

Late filing or underpayment results in penalties and interest. The Portuguese Tax Authority uses advanced digital systems to cross-check data from employers, banks, and registries, reducing opportunities for evasion. Expatriates must ensure that foreign income is declared properly, especially under the NHR regime, where reporting obligations remain despite reduced or zero effective taxation.

For North American expatriates, compliance includes managing obligations in both Portugal and the home country. U.S. citizens must file annual returns with the IRS and report foreign bank accounts (FBAR). Canadians must determine whether their move has broken residency ties under Canada Revenue Agency rules. Coordinating both systems requires professional advice but ensures that relocation remains financially efficient.